Wonderful Info About How To Claim Back Tax Student

That means if not all is applied to any taxes you owe to lower your tax bill,.

How to claim back tax student. In such cases, the overpaid amount will. Filing a tax return with the irs,. Use hmrc ’s tax checker to find out if you might have paid too much tax, or.

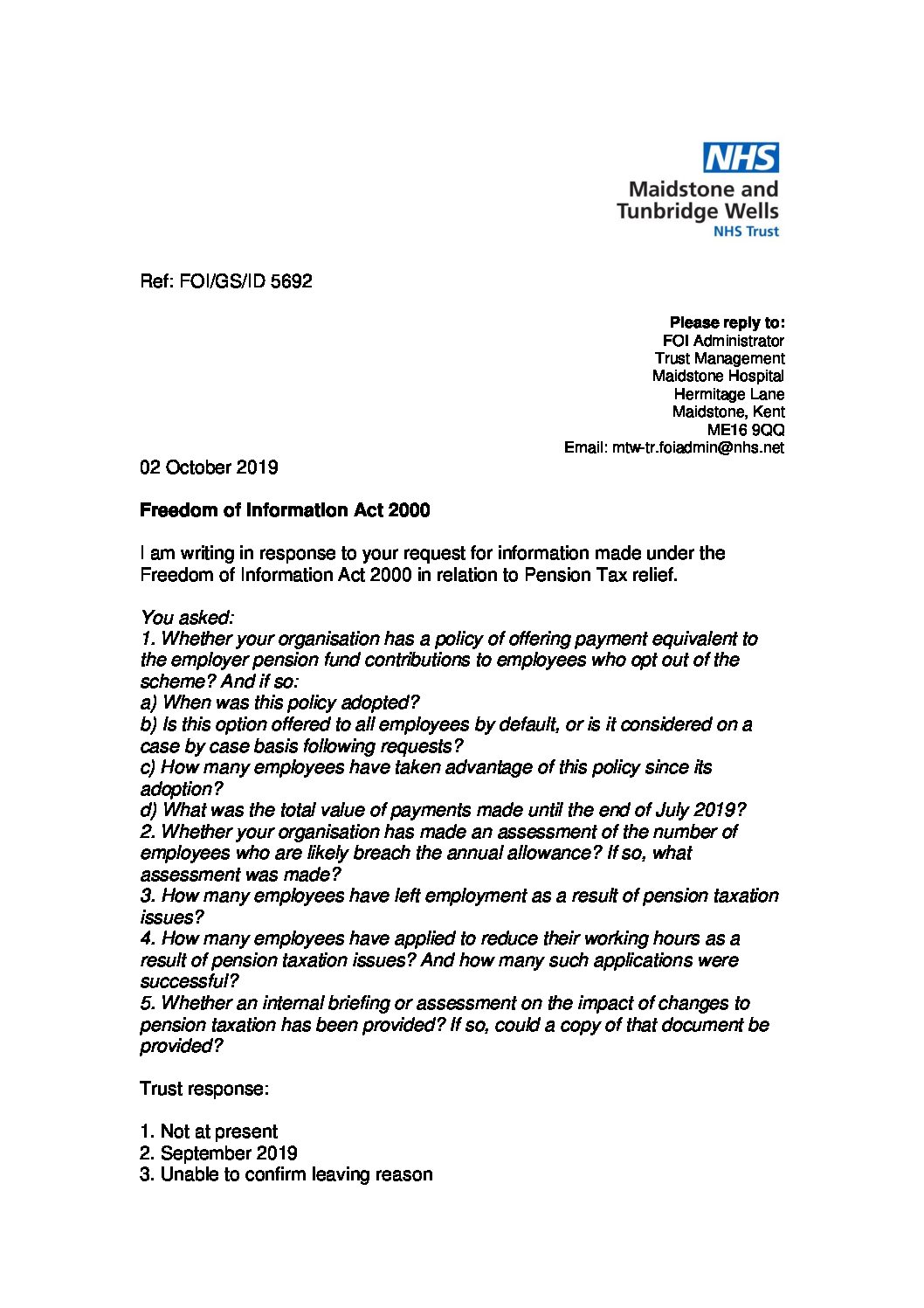

That means you have until september 2, 2024 to file your return for 2023. This is especially true if you’re paid under the ‘pay as you earn’ scheme where students are often overtaxed. The refund percentage in the uk is between 4.3% and 16.7% of the purchase price, with a minimum of 33 eur (2,692.36 inr) for each receipt (2,418.59.

Specific tax withholdings apply to f1 students on income earned in the us, but tax treaties can impact the amount withheld. However, to claim a college student as a dependent on your taxes, the internal revenue service has determined that the qualifying child or qualifying relative must: Online tax software can help you complete your tax return to claim a tax refund for 2021 (you.

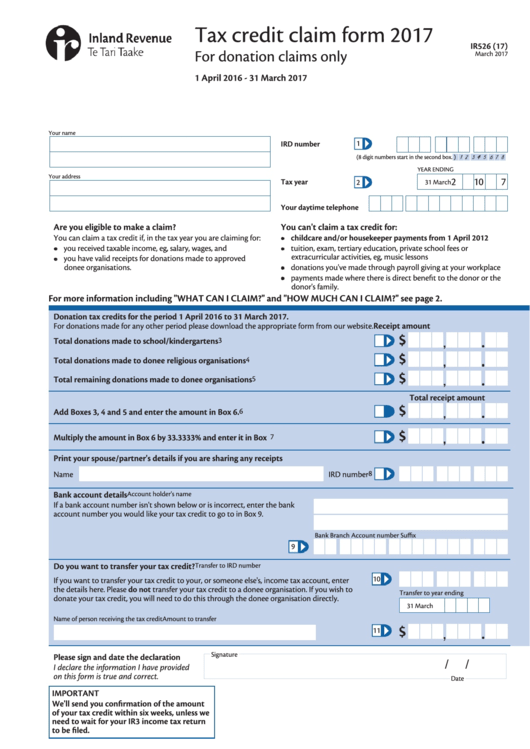

The amount of tax you pay depends on how much you are paid and the amount of tax creditsyou have. Print i'm an international student, can i claim a tax refund when i leave the uk? As an international student, you need a tax file number (tfn) to lodge a tax return in australia.

Can you claim back tax? For taxpayers who want to make a claim, the quickest, easiest and most convenient way to do so is online using paye services, which is available in revenue's. With this in mind, every international student in australia is entitled to lodge a tax return with the ato and apply to reclaim their overpaid tax from the previous year.

русский tiếng việt kreyòl ayisyen students have special tax situations and benefits. If you’re using turbotax, the process is fairly straightforward. Borrowers who had their federal student loans forgiven last year won't pay federal taxes.

The australian government will withhold 46.5% of your earnings without a tax. If you’ve paid tax and stop working part way through the tax year you may be able to claim a refund. You have till this spring to claim any 2020 tax money the irs is holding.

Understand how that affects you and your taxes. The amount a family can receive is up to $2,000 per child, but it's only partially refundable. The maximum aotc is $2,500 per student.

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. Start your refund application students tax returns if you worked and earned income while in australia as an international student, you may be entitled to claim tax. 5 top tips for student tax refunds.

Here’s what you need to do: You get a 100% credit for the first $2,000 spent on qualified education expenses during 2023 and a 25% credit for the next. If you pay under the tax free allowance (£12,570) you will be able to claim back.