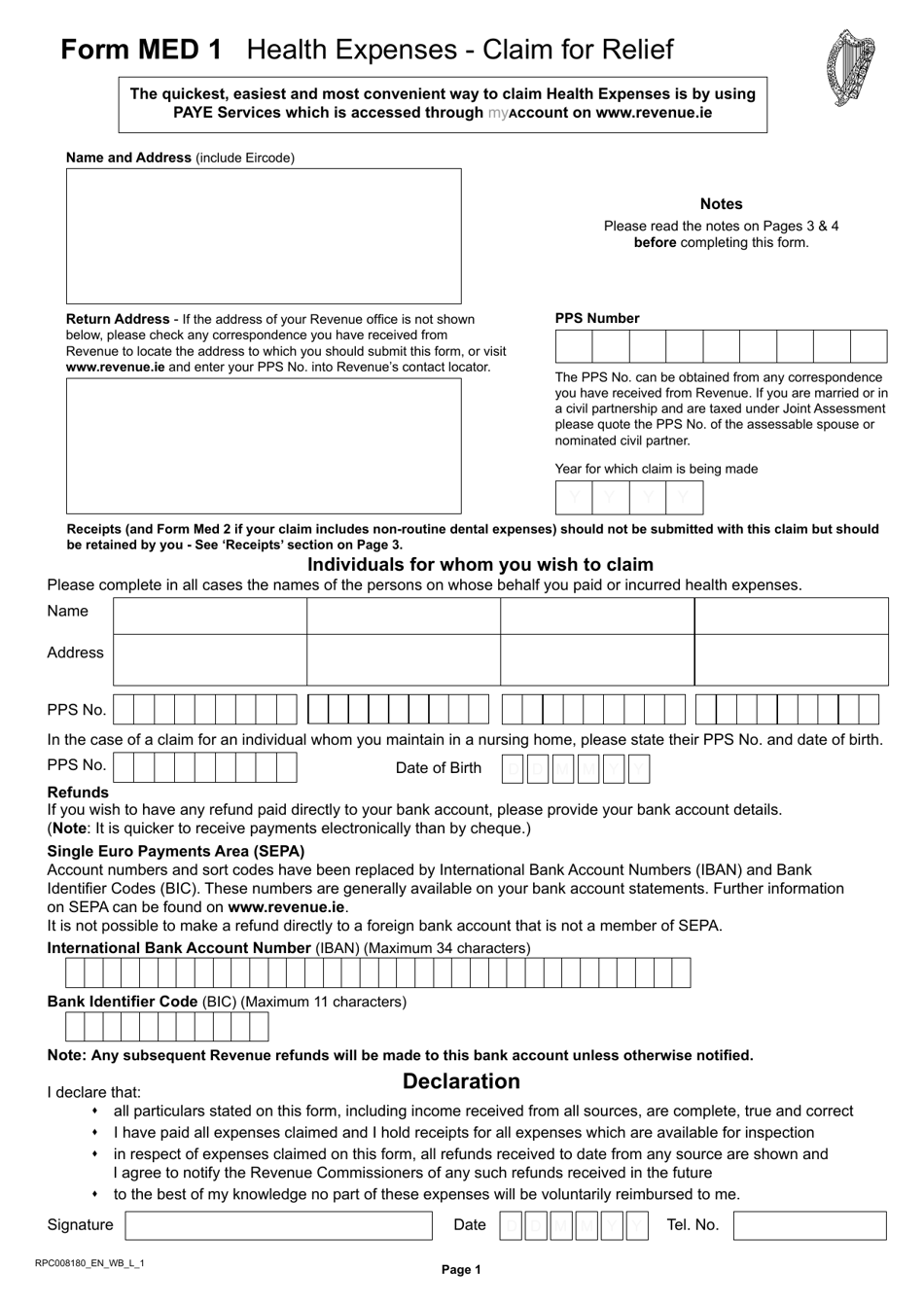

Casual Info About How To Claim Med 1

Certain costs related to nutrition, wellness, and general health are considered.

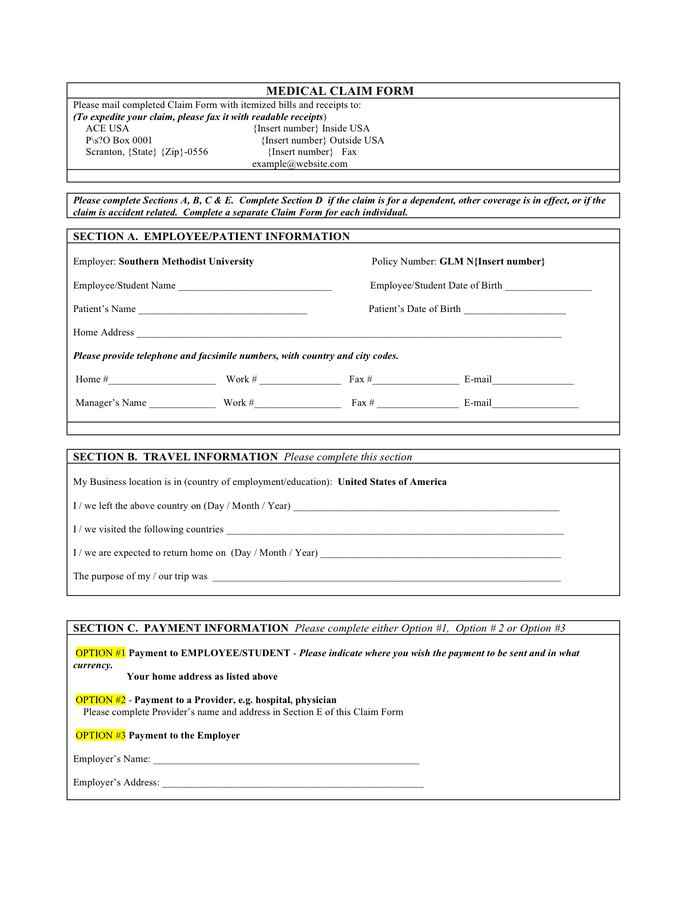

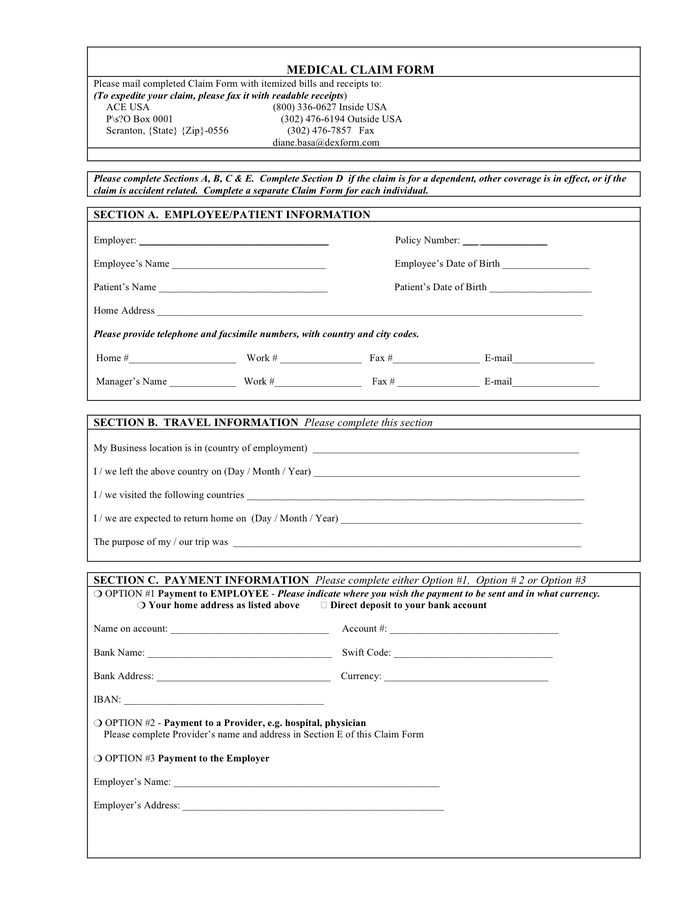

How to claim med 1. How to claim medical expenses. South korea filed a criminal complaint against five doctors it suspects of encouraging a mass walkout of trainee doctors, taking the first legal step that. The $1 billion gift is the largest donation ever made to any medical school in the country, the college said in a statement monday.

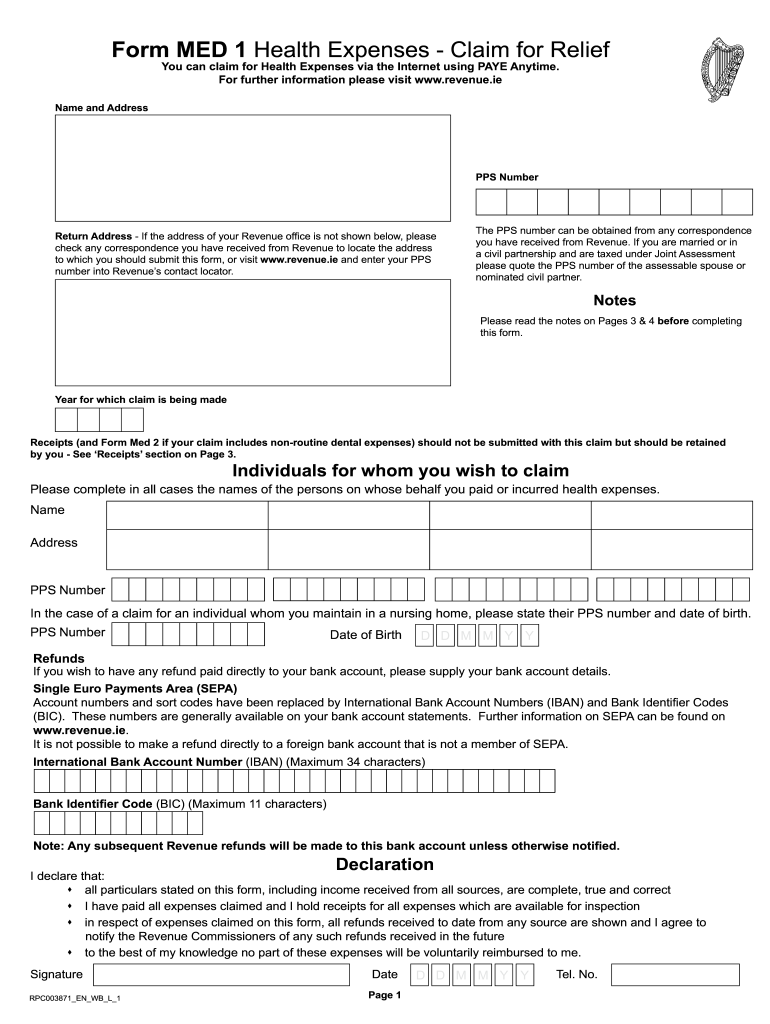

For eg, medical allowance is exempt up to inr 15,000 on a reimbursement basis. For further information please visit www.revenue.ie. Tax relief for most expenses is at the standard.

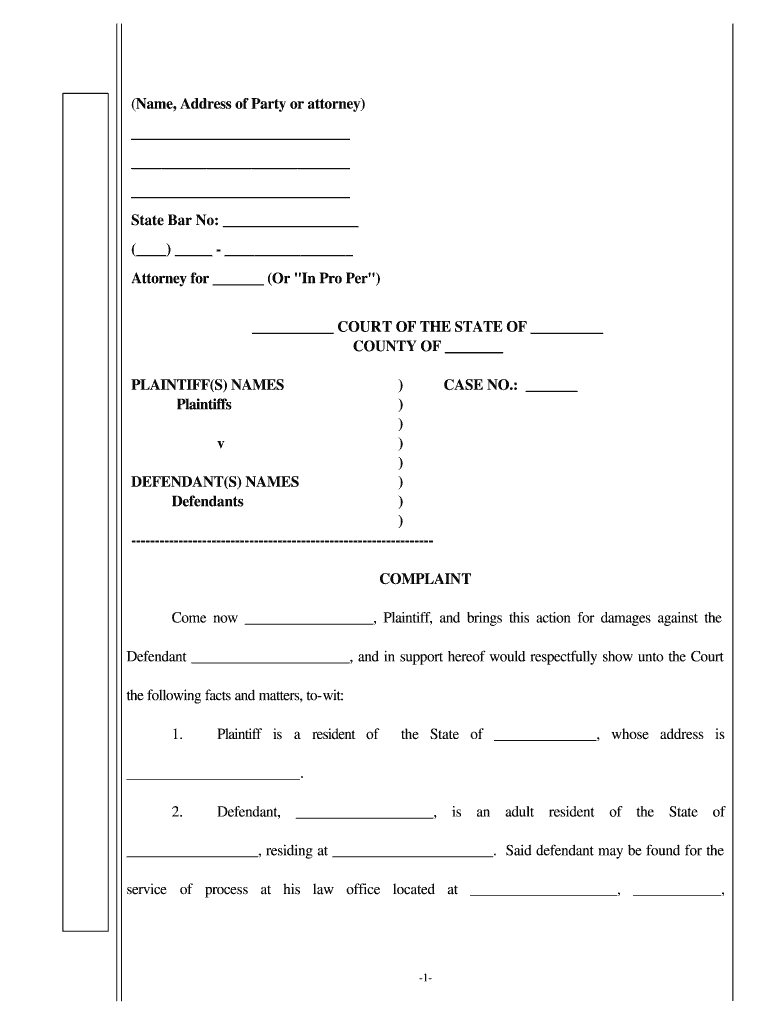

Children education allowance is exempt up to rs. Given the severity of your dad's injury and the subsequent impact on his ability to work, an attorney can also help explore additional legal avenues such as pursuing a. Health expenses are claimed through your tax return form.

200 per child per month up to a. Claiming medical expense deductions on your tax return is one way to lower your tax bill. The reported leak of chinese hacking documents supports experts' warnings about how compromised the us could be.

More than 570 documents that appeared to. Download medical forms med 1 med 1 form as you may know, you can claim tax relief for eligible medical expenses. For further information please visit www.revenue.ie name.

For further information please visit www.revenue.ie name. You must also be married or in a civil partnership and be jointly assessed for income tax. In the past, when making a claim you would complete a.

On your own behalf on behalf of a dependent (see definition below) on behalf of a relative. To accomplish this, your deductions must be from a list approved by the. Include this amount in your health expenses claim under the non.

You can claim relief on health expenses after the year has ended. For further information please visit www.revenue.ie name. You may claim a refund of tax in respect of medical expenses paid or incurred by you:

If you're itemizing on your tax return, you can deduct medical expenses exceeding 7.5% of your adjusted gross income (agi). To make a claim in the current tax year, please follow these steps: How to apply more information introduction you can claim income tax back on some types of healthcare expenses.

Click on the 'manage your tax. The quickest and easiest way to claim relief is through myaccount. How to claim dental expenses.