Breathtaking Info About How To Handle Credit Card Debt

Several different strategies can help you get out of credit card debt, from payoff plans like the avalanche and snowball methods, to consolidation products like balance transfer credit.

How to handle credit card debt. Paying the entire balance on time means you won’t be socked with exorbitant interest charges. Managing your credit card debt is key to maintaining healthy finances and a strong credit score. If you have multiple cards — and most people do — ms.

Evaluate your finances a good first step toward getting out of credit card debt is to assess your financial situation. How to get out of credit card debt 1. As you direct your larger payments toward that balance, you continue to make the minimum payments on your other accounts so you don’t end up paying late fees, hurting your credit or even defaulting.

Commissions do not affect our. How to pay off credit card debt 1. Find a payment strategy or two.

The fine print in your credit card agreement gives the issuer a lot of ammunition to make your life miserable if you’re late on a payment. Start by using your first credit card for a basic expense or two each month, and be sure to pay the entire balance when it’s due. There are different options for credit card debt settlement.

What is the best way to pay off credit card debt? If getting rid of those credit cards freaks you out because you use them “for emergencies,”. The best way to break out of the credit card debt cycle is to create a monthly budget, consolidate your debts, build an emergency fund and put a pause on credit card spending.

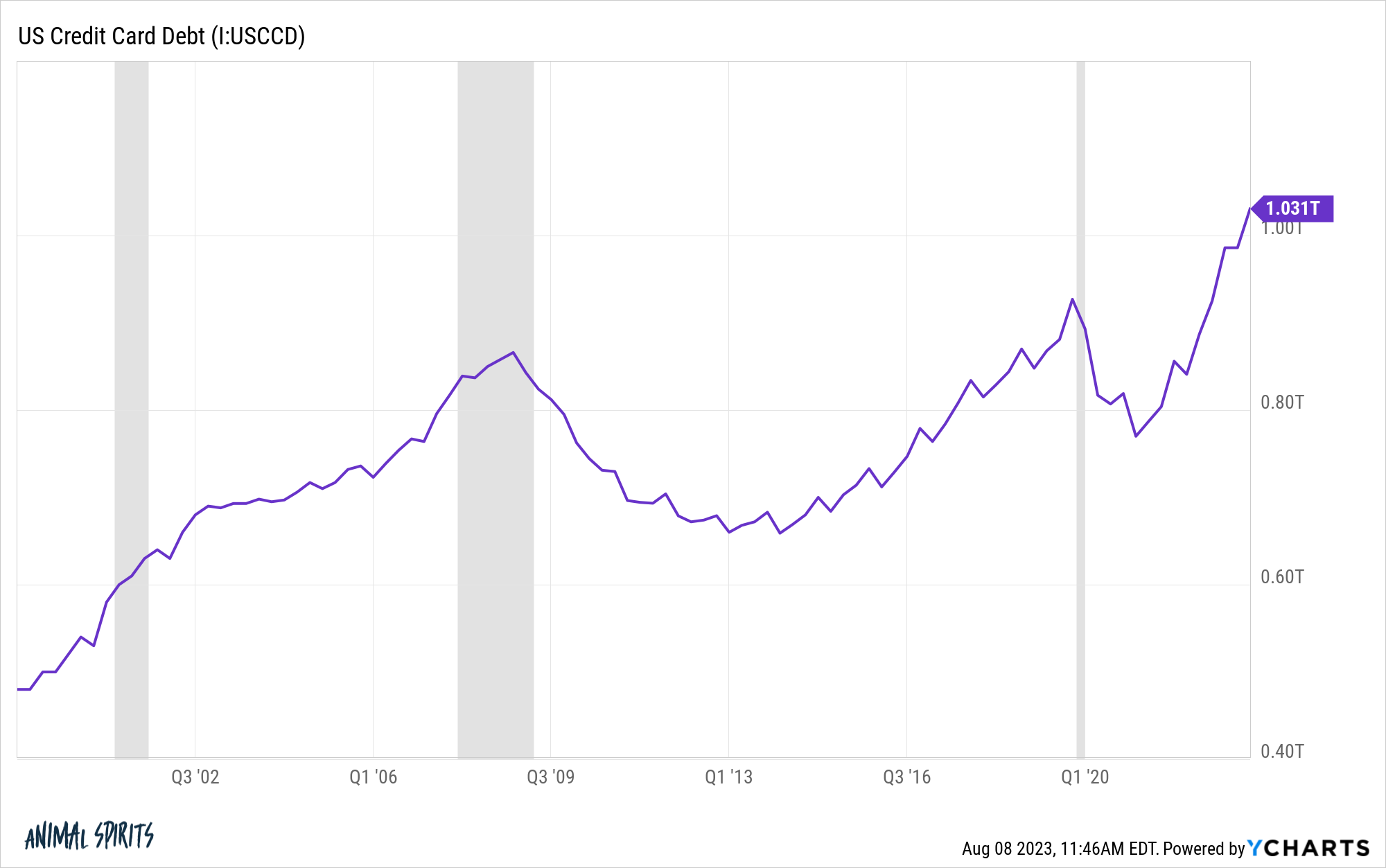

Americans collectively hold $1.13 trillion in credit card debt as of the. You might get a letter from your credit card company offering you a repayment plan. Consider these methods to help you pay off your credit card debt faster.

5 steps to pay off credit card debt. To pay off your credit card debt, you’ll. Consolidate credit card debt.

Here are a few of the best ways to get out of the red. You’ll also find details on the best practices for managing credit card debt and answers to frequently asked questions. Seek help (if you need it) 7.

Jenn underwood contributor fact checked caroline lupini editor updated: After all, the high interest rates that credit cards can come with make credit card debt difficult to pay off. You can still use cash or a debit card for some expenses, and a.

Choose a payoff strategy based on your personal situation there’s a reason the debt snowball method is popular. The first step to solving any problem is to acknowledge it fully. But for those people already struggling, the following are some simple steps for reducing one's credit card debt.