Casual Info About How To Increase Government Revenue

Perhaps the simplest option for the chancellor if he wishes to raise revenue in the budget would be to increase the rates of income tax or national insurance contributions (nics).

How to increase government revenue. In the first quarter of 2020, the federal government made n950.56 billion in revenue. Here’s how to increase government revenues without raising taxes the most important ingredient in economic growth is people money. That’s barely enough for governments to carry out the most basic state functions.

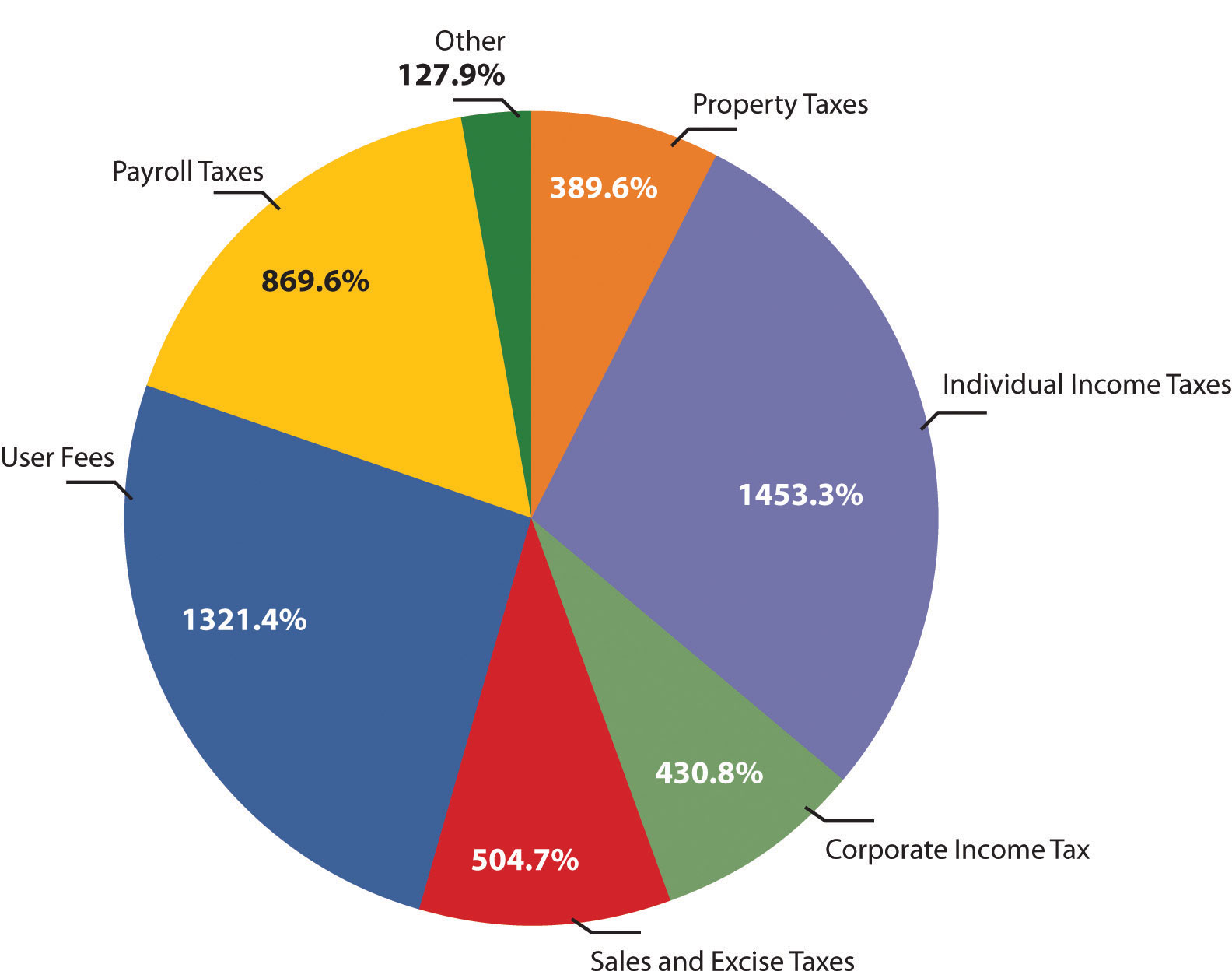

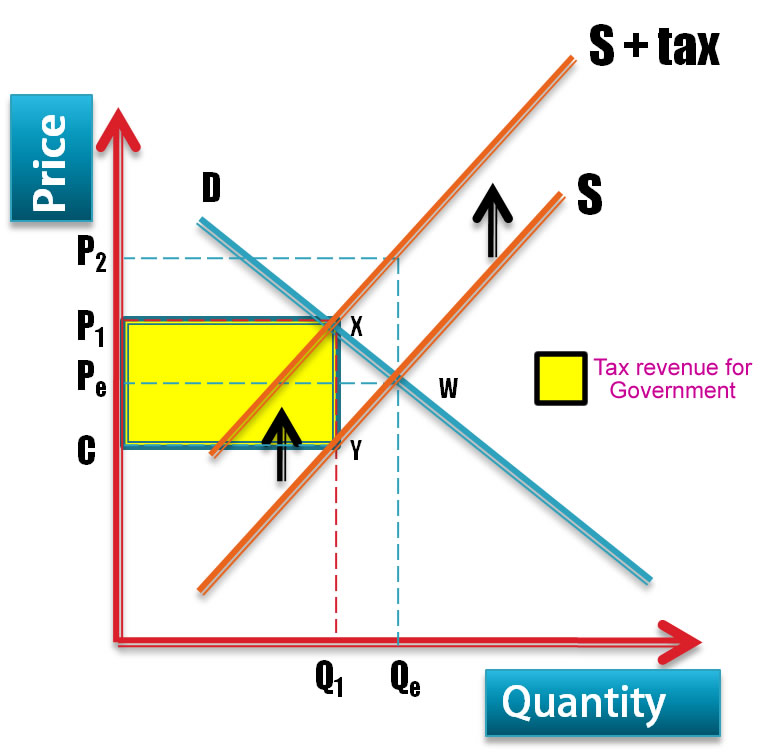

Viewpoint stephen poloz: Policymakers can directly increase revenues by increasing tax rates, reducing tax breaks, expanding the tax base, improving enforcement, and levying new taxes. 15 ways insight increases revenue opportunities for government services governmental agencies will increase revenue in the followings ways using insight:

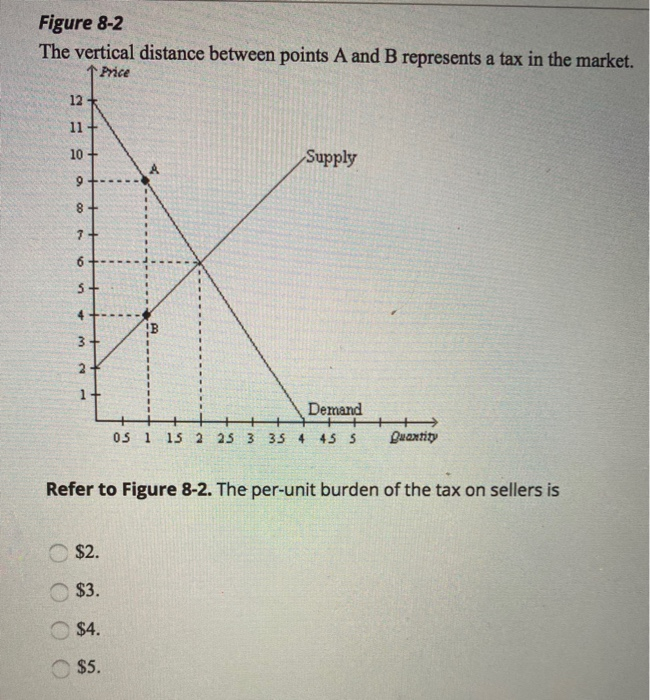

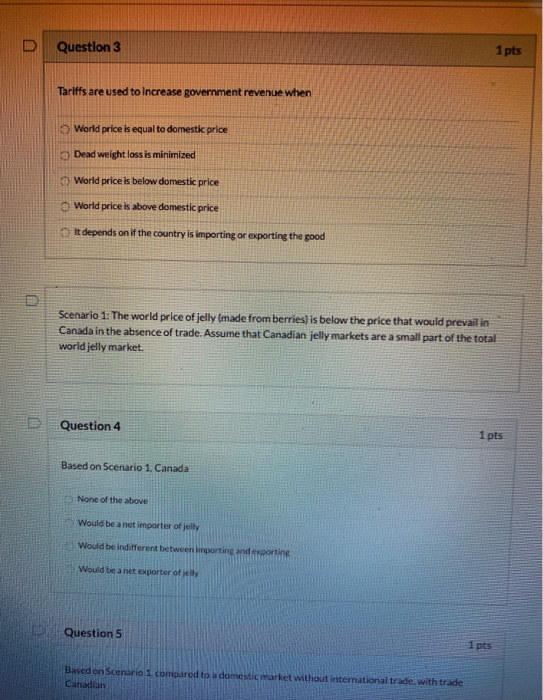

Government increases tariffs on imports from a particular country or countries, it could increase revenues, depending on the level of trade the u.s. Digital processing and automated revenue. To meet rising expectations for service delivery amid tight budgets, municipal governments must increase revenues from existing sources as well as create new.

Of this amount, n943.12 billion went into debt servicing,. This level of taxation is an. Chan on wednesday also announced that the government would set over hk$1.1 billion aside to promote mega events and boost tourism in hong kong, in a.

In parallel, the government lowered the minimum capital required to start a business, which also generated more tax revenue. Measures that can be taken to increase local government revenue in ghana, nigeria, and other west african countries include improved revenue collection procedures, public. The improvement in the country’s ability to mobilize.

While increasing the tobacco tax was mainly meant to reduce smoking, the move is projected to boost government revenue by hk$1.24 billion each year. Countries collecting less than 15% of gdp in taxes must increase their revenue collection in order to meet basic needs of citizens and businesses. To raise revenue in a progressive, efficient, and administrable manner, this chapter proposes a new national consumption tax:

If the u.s. This strategy contributed to a remarkable increase in total government revenue—from about 20 per cent of gdp in 2009 to 28 percent in 2014. Merely hiking tax rates would be counterproductive: