Lessons I Learned From Info About How To Make Money Off Bonds

Bonds can be intimidating.

How to make money off bonds. Investors (the holders of the bond) can make money on bonds in two ways. There are two ways to make money on bonds: While many investors regard them as a necessary component of a balanced portfolio, that doesn't mean they have a good understanding of.

When you purchase a bond,. Earning income from bonds. Through interest payments and selling a bond for more than you paid.

If you're ready to take charge of your savings, we cover five ways to increase your interest earnings. Bond traders are bracing for the risk of a renewed selloff, driving a surge of trading in options targeting higher yields and prompting investors to unwind long. Explain how to make money from bonds.

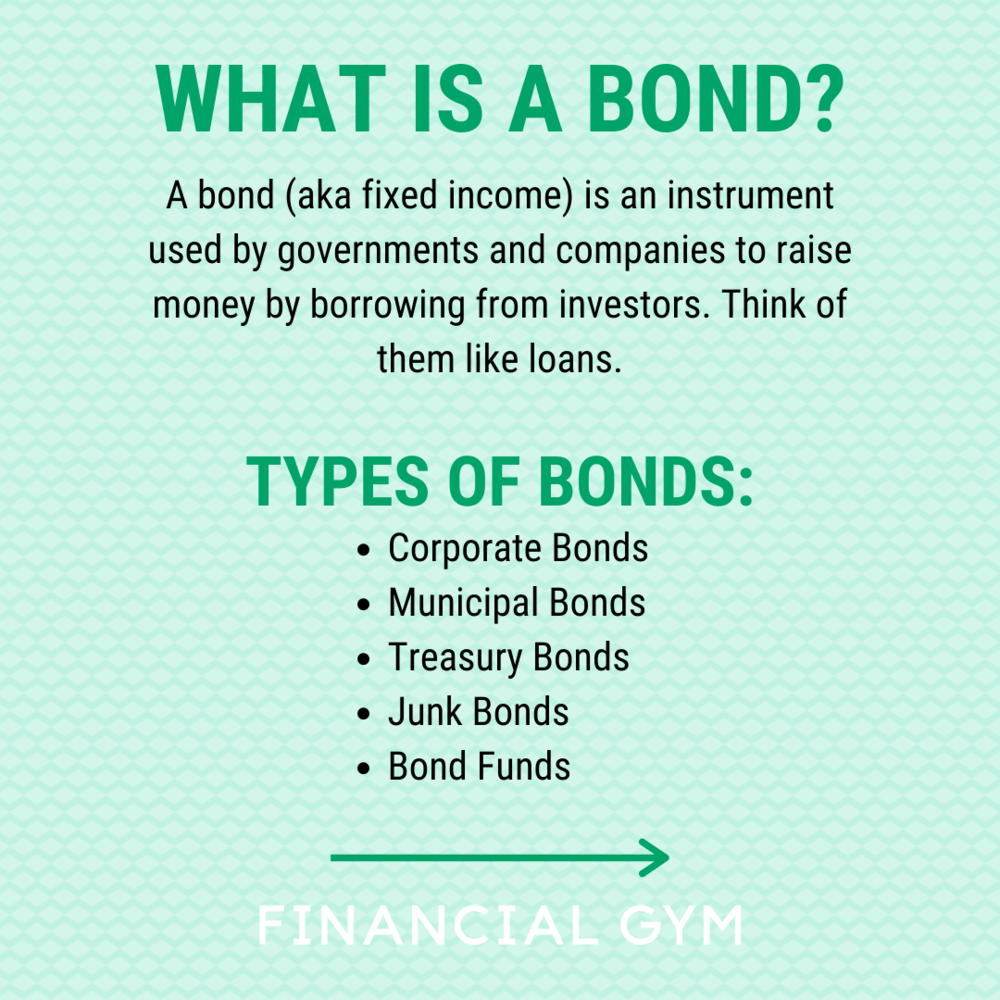

3 drawbacks to investing in bonds. Bonds are a popular investment instrument that allows individuals, corporations, and governments to raise capital by issuing debt. There are two ways to make money by investing in bonds.

How do bonds generate a return? You get regular interest payments based on the value and interest rate of the bond. The individual investor buys bonds directly, with the aim of holding them until they mature in order to.

These bonds generate income through a unique combination of a fixed interest rate, which remains the same for the life of the bond, and an inflation rate,. Describe the role of the secondary. The value is worked out by a combination of the value of the.

Former president donald trump will need to secure a massive bond as he appeals the new york civil fraud trial ruling ordering him to pay more than. Bonds are not without drawbacks. Discuss key criteria for bond selection.

Bonds are essential to a diverse investment portfolio. How is money lost on bonds? Coupon paying bonds are bonds that offer a fixed amount of payment regularly.

The biggest way to make money off bonds is through the interest payments. This beginner's guide explains how to invest in bonds, including municipal bonds, commercial bonds, savings bonds, treasury bonds, and more. There are a couple of powerful ways you can benefit from coupon paying bonds.

The first is to hold those bonds until their maturity date and collect interest payments on them. Most bonds aren’t high earners for your portfolio. Learn the different types of bonds and how to evaluate them before you buy through a.

/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

-min.png)

/do0bihdskp9dy.cloudfront.net/05-08-2021/t_b48fb2846121428ca33f0e9e5907bffb_name_t_f80c6011cb1942e68c92da0cfb6ee527_name_file_1280x720_2000_v3_1_.jpg)