Fun Tips About How To Check Your Income Tax

File up to 2x faster than traditional options.* get your refund, and get on with your life.

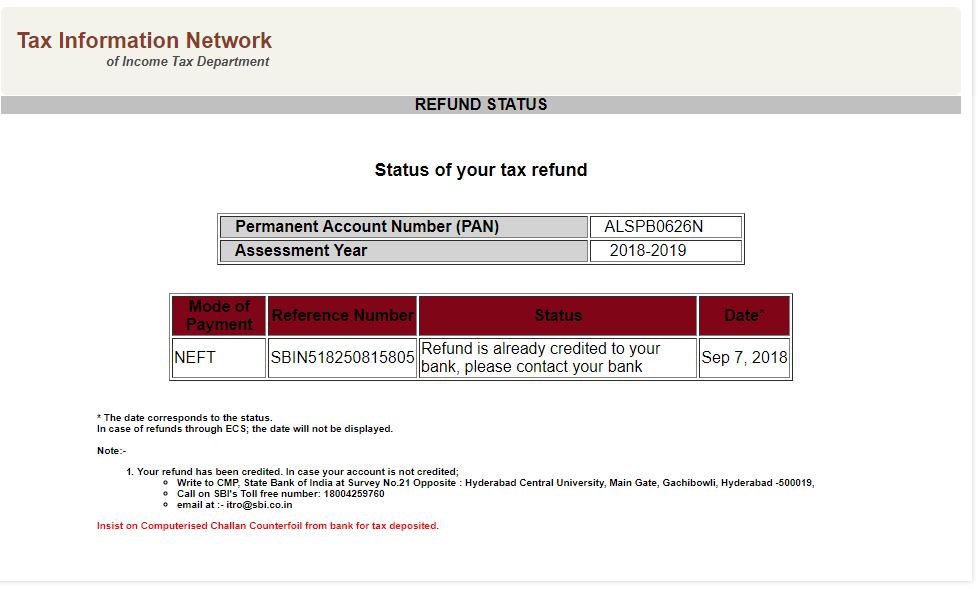

How to check your income tax. On the income tax return (itr) status page, enter your acknowledgement. Taxpayers can start checking their refund status. You will need the following information when checking refund status:

See if your federal or state tax return was. For the current tax year (6 april 2023 to 5 april 2024), you can: Check your income tax payments.

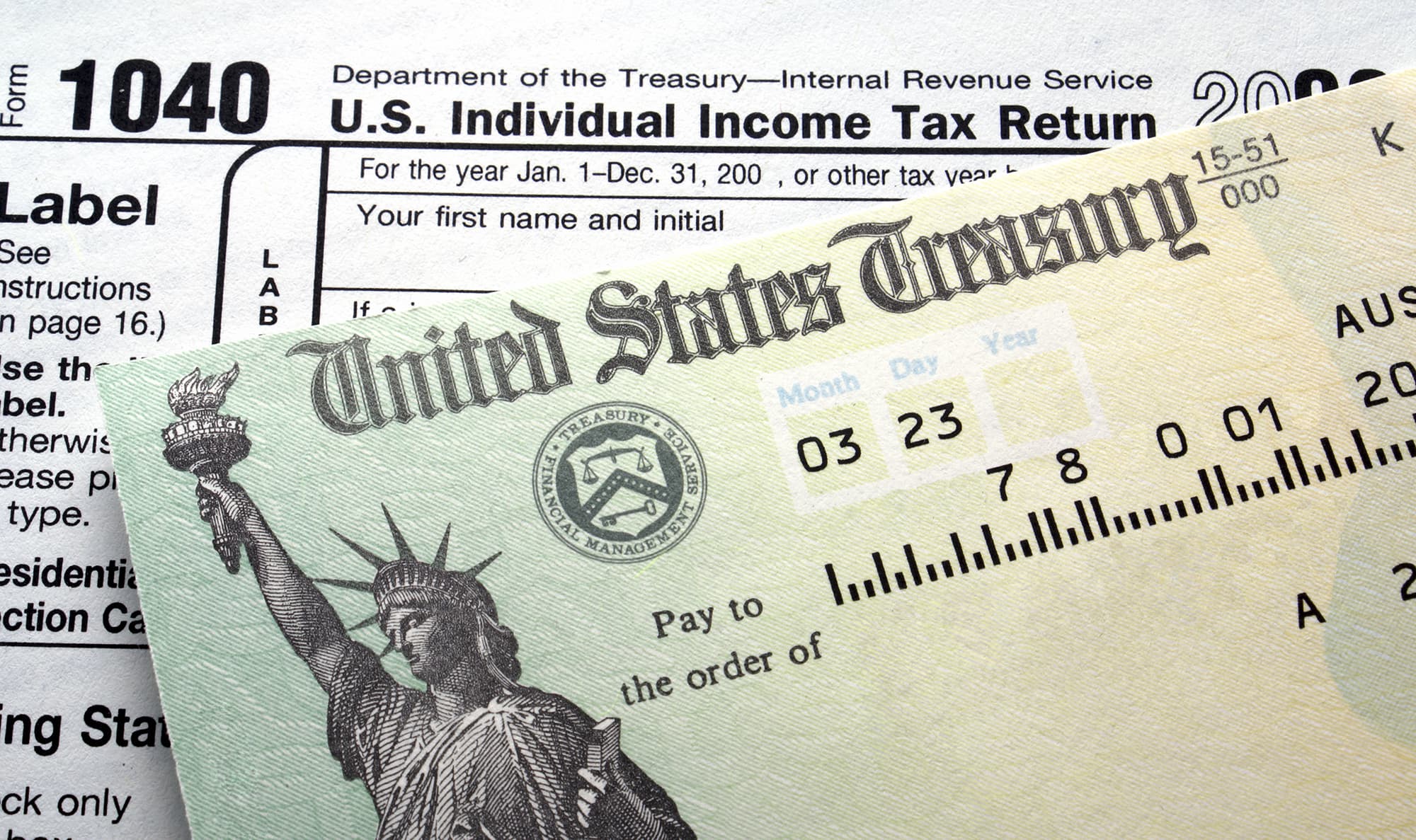

Work out how much income tax you should be paying. Explore options for getting your federal tax refund, how to check your refund status, how to adjust next year’s refund and how to resolve refund problems. The exact refund amount on your return.

Taxpayers who want to check their account information including balance, payments, tax records and more, can. Check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more. Fill in, send and view a personal tax return.

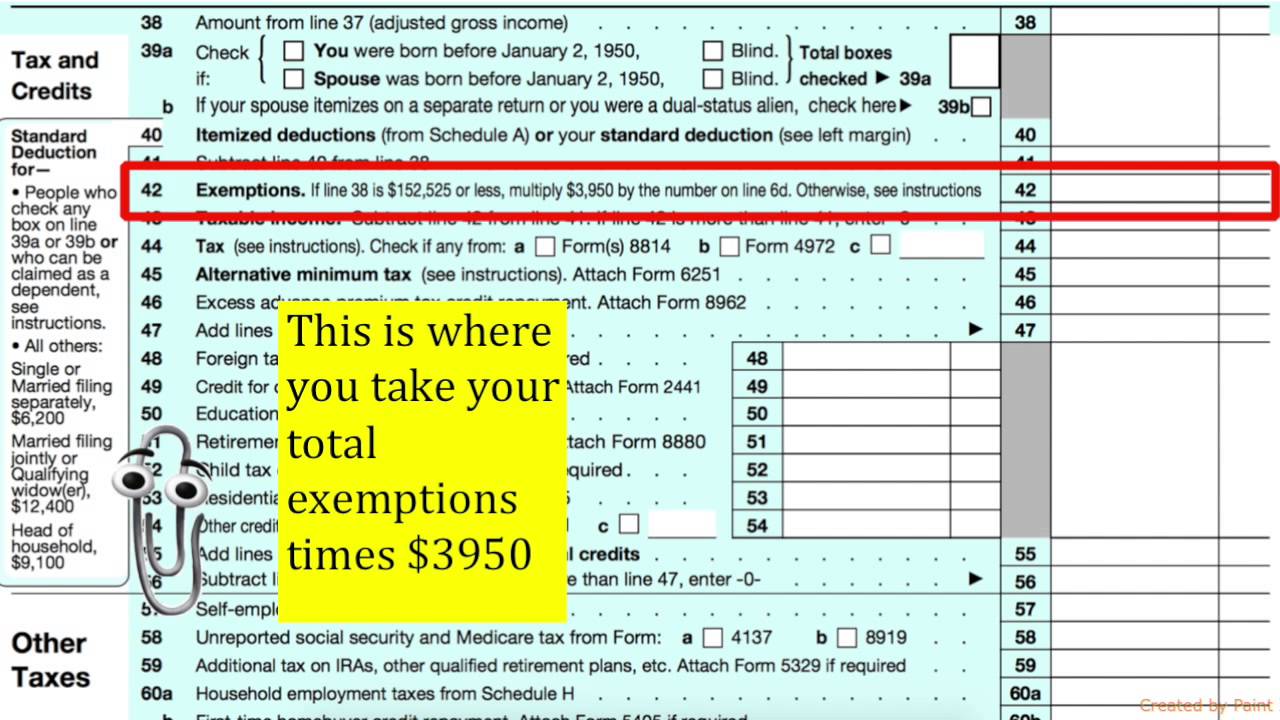

How your income is calculated for tax purposes. If you filed your taxes online. Social security number or itin, your filing status, and your exact federal tax refund amount.

There’s a different way to check how much income tax you paid last year(6 april 2022 to 5 april 2023). In order to check the status of your case as to whether tax demand has been waived off, the department advises taxpayers to log into their. Use turbotax, irs, and state resources to track your tax refund, check.

Check your federal tax withholding. View your tax records, adjusted gross income and. Was your tax return received.

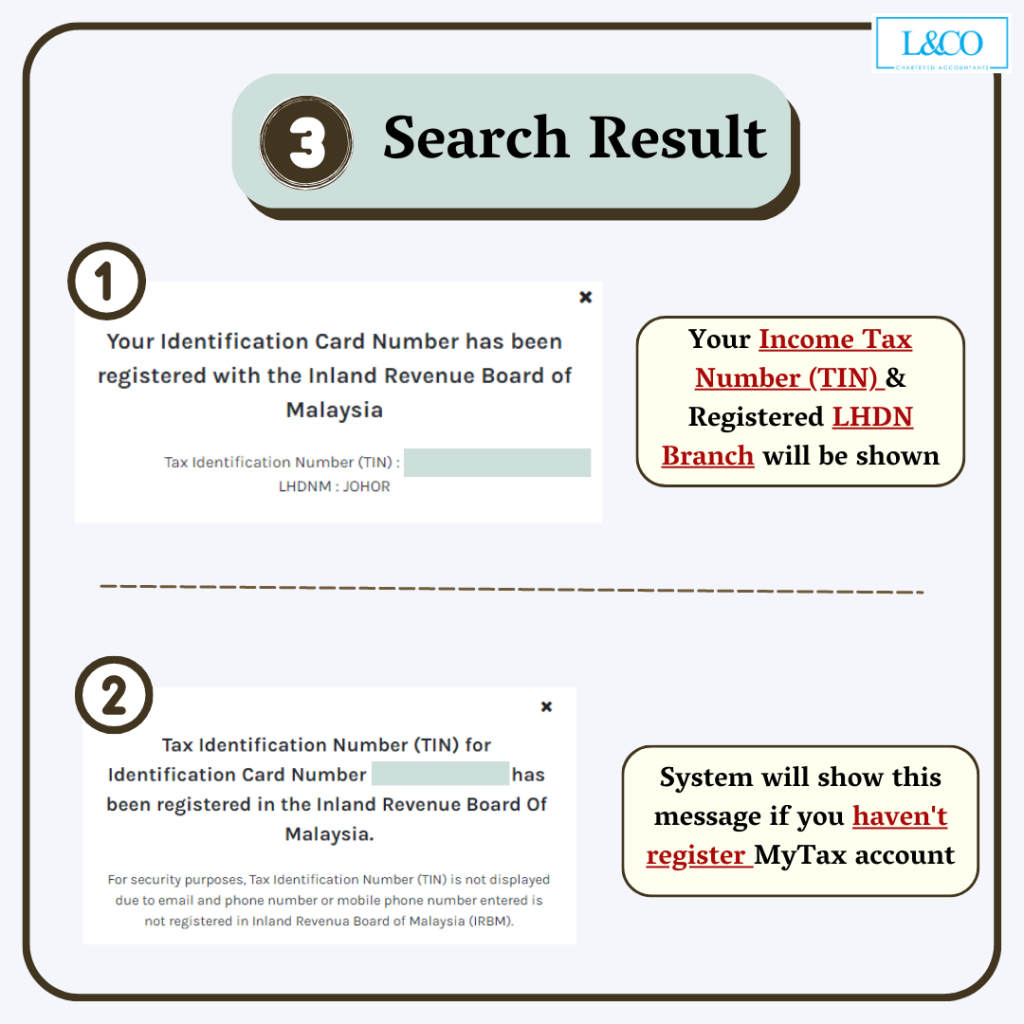

Click income tax return (itr) status. The exact whole dollar amount of your refund. Sign in to your online account.

You may start filing for the year of assessment 2024 from 1 mar 2024. Find out if your federal or state tax return was received. If you're a new user, have your photo identification ready.

Your social security or individual taxpayer id number (itin) your filing status. Interest earned on your savings is classified as earned income by the irs. To check your refund's status you'll need your social security number, filing status and the amount of money you're owed as a refund.